You’ve got hundreds of metrics to judge your store by–average order value, monthly revenue, growth, churn, customer lifetime value, daily visits and more. But which one is the most important of these?

You’ve got hundreds of metrics to judge your store by–average order value, monthly revenue, growth, churn, customer lifetime value, daily visits and more. But which one is the most important of these?

Only one metric truly indicates whether your store is growing, shrinking or stuck on a plateau. It’s the one metric that, when increased, will have direct, long-term and substantial impact on your store’s longevity and profitability.

That North Star metric: Customer Lifetime Value (abbreviated CLV or CLTV). In this article, we’ll tell you how you can improve customer lifetime value for your ecommerce business.

Why Is Customer Lifetime Value Important?

Customer Lifetime Value is simply the amount of money you make from a single paying user on your store during their lifetime of business with you.

The truth is, not all customers are created equal. In fact, the top 1% of ecommerce customers are worth up to 18 times more than average customers.

You need to be able to focus your efforts on acquiring those top customers—the customers who will raise your business up and to the right on a profitability graph.

CLTV is the best analytics metric

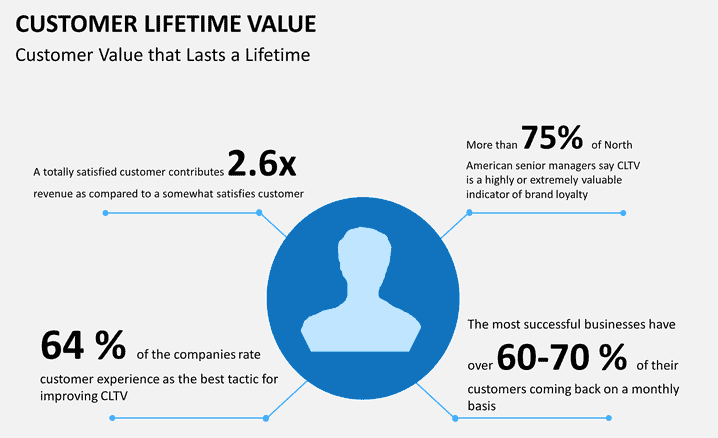

Customer Lifetime Value beats everything else because it focuses on long-term value, not the quick, spiky behavior of flash sales and seasonal fluctuations. Lifetime value clears your view by leveling the peaks and troughs into a straight line of either success or failure.

Analytics guru Avinash Kaushik loves LTV, saying “focusing on real success….finding the customers that create value for the company….[and] doing the kind of Analysis Ninja work that solves tomorrow’s problems today!”

CLTV affects every area of business

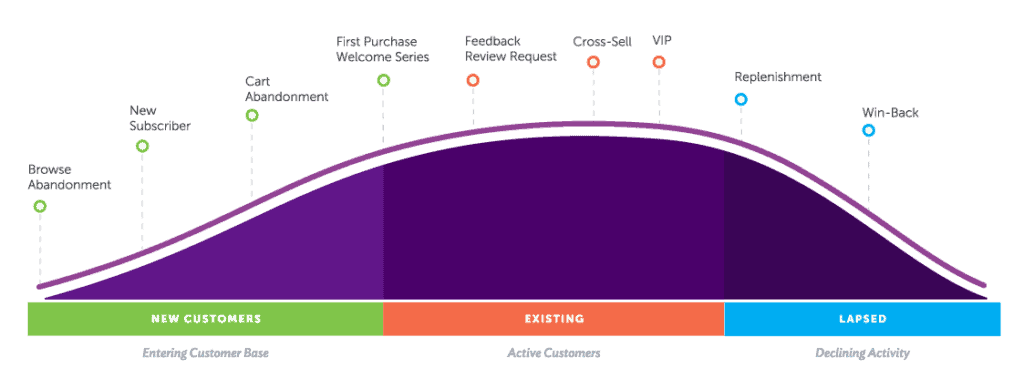

Customer Lifetime Value matters because it affects every area of your business. Take a look at how the customer’s life cycle impacts virtually every sector of your business.

Every single step of the way, a customer’s engagement and decisions are being influenced by you and their overall desire to buy from you is driven by each of those “micro-engagements”. When you can optimize your business to keep customers at every stage of that lifecycle, you are gaining significant customer lifetime value.

Most stores optimize for the initial sale. That’s missing a huge number of chances to get more sales from your existing customers.

Increasing CLV means higher profits.

CLV is also important because it shows you the path to achieve higher profits. If you increase your lifetime value, then you increase profits, plain and simple.

According to Marketing Metrics, convincing a new prospect has a low chance of success (in the 5-20% if you’re lucky). Compare that with selling to an existing customer: They are 60-70% more likely to buy from you if they bought something in the past. By focusing on returning customers and their lifetime value, you focus on a strategy to increase profit margins directly.

…But Customer Lifetime Value is Not Easy To Calculate

While CLV is very useful, calculating it is a challenge. If you’ve tried this before, you’ve probably ended up with lots of Excel spreadsheets, complex formulas and database queries that make your head spin.

(Thankfully, Recapture added CLV as a built-in calculation for your store as of July, 2018!)

Finding the right model is tough, and it’s even tougher to keep on top of that data all the time. Customer behaviors are very difficult to predict and appear random on the surface, making CLV a complex metric to track.

Here’s just a few of the things that make CLV difficult:

- Some customers make small, weekly buys, others may buy once a year but get something big

- What about large vs. small purchases? Or recurring subscriptions?

- What if you haven’t been in business that long? How do you know what the purchase frequency will be?

Knowing CLV helps your understand current AND future customer behavior. By calculating your CLV, you’ll be able to understand how often certain types of customers will make purchases and when those same customers will stop making purchases altogether.

Although there are some more advanced methods for forecasting CLV out there, the take away is simple: Knowing your CLV is powerful and important. And because calculating this is hard (except in Recapture), stores that have it are better placed to make better decisions about marketing efforts and measuring results.

You can’t fix what you don’t understand. Having this number is a critical start.

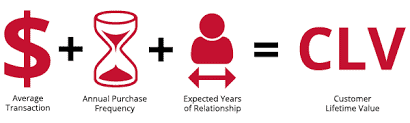

What goes into calculating Customer Lifetime Value?

There are 3 key metrics that Recapture uses for CLV. You can find them individually in your store’s data, but we track them for you. They are:

- Average Order Value

- Purchase Frequency

- Customer Value

1) Average Order Value

Average Order Value represents the median amount of money that a customer spends each time they place an order. To get this number, we take your total revenue over a given timeframe and divide it by your total number of orders.

Average Order Value = Total Sales / Order Count

2) Purchase Frequency

Purchase Frequency represents the average amount of orders placed by each customer. Using the same timeframe as your Average Order Value calculations, divide your total number of orders by your total number of unique customers. The result will be your Purchase Frequency.

Purchase Frequency = Total Orders / Total Customers

3) Customer Value

Customer Value represents the average amount of money that each customer brings to your business during that timeframe. To get Customer Value, multiply your Average Order Value by your Purchase Frequency.

Customer Value = Average Order Value x Purchase Frequency

Putting it together: Customer Lifetime Value

Customer Lifetime Value is how much customer value you get over the average customer lifespan in your store. To get CLV multiple your Customer Value by the average customer lifespan.

Customer Lifetime Value = Customer Value x Average Customer Lifespan

Your average customer lifespan is the length of time customer is actively buying from you. This is where things get a bit tricky because there are two types of customers…

How Often Do Customers Come Back?

Lifespan has everything to do with how frequently the customer must return to do business for you. Your business falls under one of two types: Contractual (like a subscription business) and Non-Contractual (everything else).

Non-contractual means your customer makes one purchase and is done, possibly forever. Sometimes, they may return to buy more but this is not common. Identifying which customers are willing to buy from this type of business again is super hard.

On the other hand, contractual businesses have customers coming back with some regular occurrence. It’s easy to determine when they stop being an active customer: When they end their contract or subscription, you know they’re done with you. And you can find out the average time a customer subscribes to your service pretty easily in your store data.

For new stores, you might not have access to enough data to determine the average lifespan length of your customers. That’s not a problem—you can make an estimate and still get reasonable results to start.

Have a new store? Just use Avinash Kaushik‘s recommendation: estimate a lifespan of three years. It turns out that will work fine as a rough estimate. It’s a reasonable starting point for how customers will potentially perform in the immediate future (as well as give you some added incentive to keep them around).

What Affects Customer Lifetime Value?

Customer Lifetime Value takes into account three primary factors: Recency, Frequency, and Monetary Value. Sometimes this is referred to as RFM Analysis.

RFM is a way to organize your customers from least valuable to most valuable, taking into account the these factors:

- Recency refers to the last time that a customer bought from you. A customer who has made a purchase recently is more likely to make a repeat purchase than a customer who hasn’t made a purchase in a long time.

- Frequency refers to how many times a customer keep buying from you in a given time frame. A customer who makes purchases often is more likely to continue to come back than a customer who rarely makes purchases.

- Monetary Value refers to the amount of money spent buying from you in that same time frame. Generally, customers who makes larger purchases are more likely to return than customers who spend less.

Let’s boil this down to simple terms. You can directly impact CLV by:

- Having customers make bigger purchases (Monetary value)

- Asking customers to come back more often (Frequency)

- Giving customers a reason to buy again immediately after purchase (Recency)

- Keeping customers around longer (Frequency and Recency both)

How can I use Customer Lifetime Value in my store?

Remember how we said knowing customer lifetime value was power? With it, you determine how much you can profitably spend on marketing campaigns.

One of the primary uses for CLV is to help you keep your Cost to Acquire Customers as low as possible.

How much are you spending to acquire new customers? Some simple math:

- Start with your total marketing or ad budget for given timeframe. (We’ll call it Total Marketing Spend)

- How many customers did you get when you ran that spend over that same timeframe? (We’ll call that New Customers Gained)

Cost to Acquire Customers = Total Marketing Spend / New Customers Gained

Now subtract your Cost to Acquire Customers from your Customer Lifetime Value. That’s your Return On Investment, or ROI.

ROI = Customer Lifetime Value (CLV) – Cost to Acquire Customers (CAC)

That’s the amount of money you get out of a customer relationship after you’ve deducted the money that you spent to start the relationship in the first place. Your profit directly comes from maximizing ROI. You can increase ROI doing one of two things:

- Increase CLV or

- Decrease CAC

By knowing your CLV, you’ll also be able to figure out how much you can afford to spend on paid ad campaigns Google and Facebook.

To determine how much you should be putting into campaigns, you’ll first need to know your conversion rate.

For instance, if your Customer Lifetime Value is $200 and the conversion rate for one of your marketing campaigns is 10%, then your maximum bid for that campaign should be 10% of $200, or $20. In this example, you can bid a maximum of $20 per click without blowing your budget.

Final Thoughts

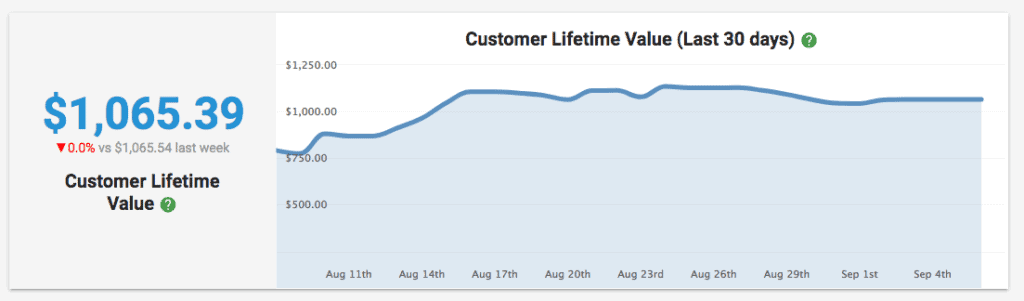

When Recapture introduced the CLV widget on the dashboard, we knew that this metric would be super important to you and your store. Increasing CLV dramatically impacts the profitability and sustainability of your store. Now you have an easy way to keep an eye on it with Recapture’s CLV dashboard:

We hope reading this article has given you a few reasons why you want to keep an eye on it and how to determine whether your marketing efforts are paying off or not.